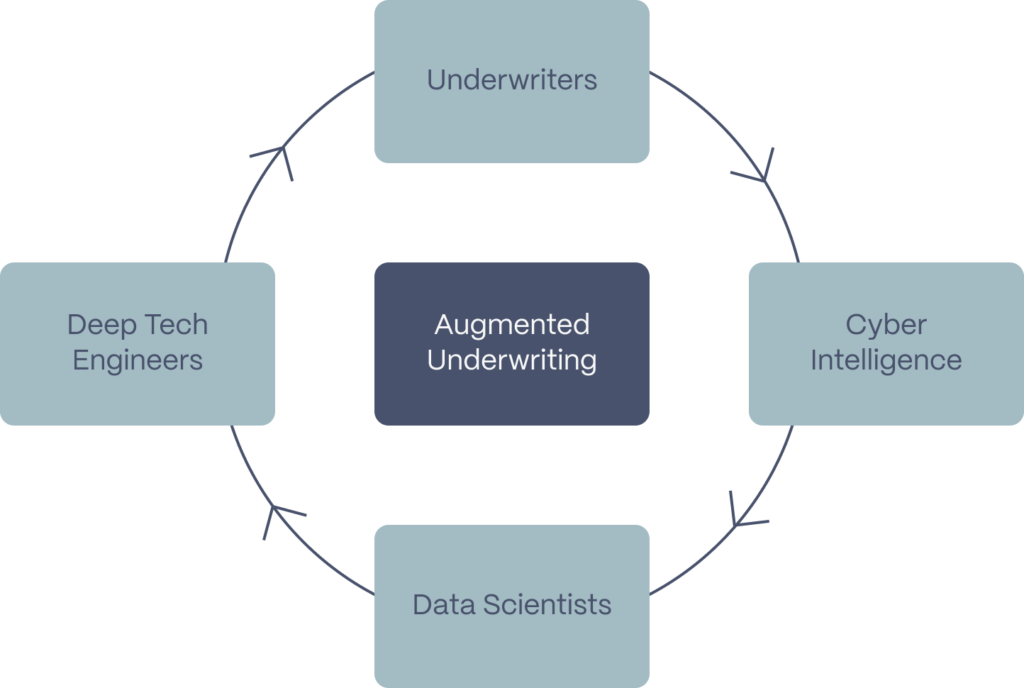

// Augmented Underwriting

Capturing the unique contributions of human expertise and AI.

We nurture close collaboration between experienced underwriters, data scientists and cyber intelligence experts.

Get in touch// The Value of Human + AI Technology

Traditional statistical methods fall short in their ability to accurately quantify complex risk dynamics - and humans alone are unable to process the massive volume and velocity of relevant data available today.

AI technology can address these challenges, combined with the best of human expertise to frame, contextualise and verify the analysis. The resulting Augmented Underwriting capability represents the state of the art in risk assessment and forecasting.

Envelop analyses cyber and other emerging risks with cross-functional teams of experts:

- Data scientists deploy advanced AI that detects signals and patterns in data to effectively quantify cyber risk.

- Underwriters overlay insurance market experience to make smarter decisions for the benefit of their partners and cedants.

- Cyber threat intelligence experts scan external data sources for emerging threats and patterns affecting the cyber risk landscape.

// Data and Collaboration

Envelop’s capability is enabled by the largest data set of cyber-related information in the marketplace.

Envelop has been deeply committed to rigorous data collection and validation since the company’s inception in 2016. The Envelop team is proud of how our underwriters, cyber threat intelligence experts and technologists have created CyberTooth and cutting-edge business intelligence tools for underwriting and portfolio management. Through this collaborative approach, we provide transparency, flexibility and explainability to build trust with our cedants and capital partners.

// CyberTooth

A proprietary risk estimation and capital management system.

Utilising AI algorithms to forecast attritional and catastrophic losses dynamically.

Learn how we use AI and human expertise to improve upon traditional rules-based scenarios and static risk models.

// Cyber Threat Intelligence

Continuous cyber threat intelligence from our in-house experts, which not only informs risk assessment and estimation, but also provides valuable insights on the threat landscape and emerging challenges.

- Real-time data to inform our risk models

- Publishing bulletins to partners and cedants on current activities

- Rapid exposure management updates